Tuesday, July 31, 2012

Portland Home Values Rise

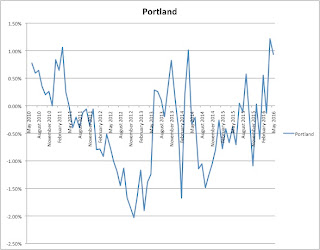

The May Case-Shiller numbers are out and the news is good for Portland. Portland saw a month over month and a year over year increase in home values. This picture above, of the seasonally adjusted C-S numbers shows the plunge and subsequent bumping along the bottom.

Here is another graph of the month-to-month percentage change in seasonally adjusted C-S numbers.

Way too early to say we are starting to see sustained appreciation but things are starting to look like we might start to see housing make a modest comeback this year.

Monday, July 30, 2012

Underemployment in the West

Quick, what do California, Oregon and Washington have in common? Among other things, the Pacific Ocean and lots of good beer among them, they all have higher than average unemployment, much higher than average underemployment and, along with Nevada, the highest difference between unemployment rates and underemployment rates.

All this according to the US Bureau of Labor Statistics and nicely summarized by the Wall Street Journal.

Theories?

All this according to the US Bureau of Labor Statistics and nicely summarized by the Wall Street Journal.

Theories?

Friday, July 27, 2012

The Merkley Plan: Big Thumbs Up

Here is Merkley doing his best Austan Goolsbee impersonation - not bad actually.

Imagine that, back in 2006, you and a mortgage company took a joint bet on the housing market. You entered into a contract for a relatively low down payment in exchange for a high interest rate. Both sides figured that within a few years the appreciation of the asset would allow refinancing at a lower rate. This contract worked well for both sides, the mortgage company benefitted from the high payments for a few years and the homebuyer was able to buy a house otherwise unavailable to them.

In fact, I did precisely this when I bought my house in Denver. I obtained a then novel interest-only loan which allowed me to afford the house initially. Two years later I was in a conventional 30 year fixed mortgage.

But of course this is all predicated on the asset appreciating. What we have now are a bunch of high-interest mortgages that are underwater and thus without hope of refinancing. The rub is that refinancing works for everyone - banks benefit because being paid back on the full value of the asset is a lot better than a short-sale and homeowners benefit through lower payments.

So now we have the plan proposed by Oregon Senator Jeff Merkley and that would facilitate exactly this exchange. Here is Felix Salmon describing it in his blog:

Merkley’s plan ... doesn’t come with any moral hazard problems attached: indeed, at the margin, it encourages homeowners to stay current on their loans, rather than defaulting on them.

The basic idea’s very simple: the government will buy, at par, any new underwater mortgage written on certain terms. So if you currently have a $240,000 mortgage on which you’re paying 8% interest, but your house is only worth $200,000 and you can’t refinance, then suddenly now you can refinance. In fact, you have three options. You can get a $240,000 15-year mortgage at 4%, which keeps your payments roughly the same, but which gets you paying down principal quickly, so that you should be above water in about three years. You can get a $240,000 30-year mortgage at 5%, which cuts your monthly payments substantially. And there’s a third option I don’t fully understand, which includes a $190,000 first mortgage at 5% and a $50,000 second mortgage with a five-year grace period; on that one, monthly payments, at least for the first five years, drop even further.

In many ways, if you don’t sell your house, this is functionally equivalent to a principal reduction. That $240,000 15-year mortgage at 4%, for instance, has exactly the same cashflow characteristics as a $198,000 15-year mortgage at 7%. And the $240,000 30-year mortgage at 5%, similarly, asks homeowners to pay exactly the same as they would if they had a $193,00 30-year mortgage at 7%.

Of course the government can do this because it can borrow money at virtually zero interest and it should do this because a moribund housing market hurts everyone through the drag on the economy. There is risk, of course, and there will be default which will make lots of great anecdotal stories about how the government is foolish, but I suspect that the US taxpayer will still come out far ahead.

One question that remains in my mind is: as are talking about subsidizing homeowners who are not delinquent ?re we really helping the housing market? I suspect many of the 'underwater' mortgages that are still current will remain this way. It is really the delinquent mortgages that are at risk of default. But something is better than nothing and this at least will ease income constraints for households.

The same holds true for the bank side: if these are high interest loans on an undervalued asset and yet they are still current - what could be better? You don't want to give up these loans. So I suspect some push-back from the banks and it will be interesting to see how the political winds blow. But, overall, kudos to Merkley for a sensible plan that addresses a real problem in housing right now in a measured and reasonable way.

Wednesday, July 25, 2012

Soccernomics: Timbers in Disarray Edition

|

| Class: Stephen Ireland was clearly the best player on the pitch last night. His movement, both laterally and vertically, never stopped. |

The dismissal of John Spencer as Manager Head Coach (it is funny how we adopt some British terms but not all) caught me by surprise. Sure the Timbers are struggling but they are a second-year expansion team with an incredibly young and inexperienced roster. What do you expect? I believe Spencer thought he had some time to build the team and it was my general opinion that he should be given three years and evaluated only at the end.

So what happened? My guess is it all comes down to Nagbe. Well, not just him, but his category: young developing players of which the Timbers have a lot: Nagbe, Mwanga, Alhassan, Renken, Rincon, Valencia, Jean-Baptiste, Mosquera, etc. If you look at Nagbe today versus a year and a half ago can you really see growth as a player? No. Is it Spencer's fault? Probably not entirely, but I suspect that this is why Paulson chose to pull the trigger so quickly. This is the only reason I can think of that you would make such a drastic move, if you think the development of these players is hurting and needs to be corrected right away.

Spencer's style is to have players play very specific roles on the pitch and he likes to play a very direct version of football. This is probably not a bad thing for a young team but it does limit creativity somewhat. Still, when Nagbe has been given a free license to be creative he has not been able to be the creative playmaker in the midfield, so I don't really think that is the problem. What then is? Not sure. I would have been more patient I think.

As for the Timbers, the aftermath has been pretty interesting to watch. The Dallas debacle was instructive: players really seemed to sort themselves. One player who I have maligned in the pans, and who has really started to play his best football, is Franck Songo'o. He is finally starting to assert himself on the field and put in a full effort. Well done. Eric Alexander is a great player until he gets to the box where his shots are, face it, terrible and his passing uninspired. If he can develop a shot he could really become a top notch player. On the other hand, Jewsbury is looking a bit tired and old these days and is not the force in the midfield he was. Palmer is a disaster - wins the ball well, but then rarely does anything useful. And the new guy - Kimura - who was supposed to solve the right back problem is horrendous. I liked Jack there better.

Last night's exhibition was a lot of fun: you get to see a lot of the youngsters like Brent Richards (man that kid's got hops) and Ryan Kawulok. Raw, but energetic. The most instructive thing for me was that even though Aston Villa was not as adept at possession ball as Valencia (the previous exhibition), they still possessed the ball better and, especially, moved the ball faster than the Timbers. The Timbers are still way too ponderous on the ball and way too static when one player is trying to dribble and break people down.

What I expect from the Timbers for the rest of the season we caught a glimpse of last night: playing compact, especially at the start there was only about 10 yards of space between each line of player. Playing youngsters more. Within the compact team play allowing players more freedom to move out of position and interchange. It'll be rough perhaps, but entertaining.

Tuesday, July 24, 2012

Economist's Notebook: Price Elasticity of Demand

We make trips to visit my mother on Bainbridge Island fairly frequently and we take the ferry whenever we can as we much prefer it to the overland route. A couple of weeks ago my older son and I were taking the ferry after walking over from the train station and while on the ferry we saw the familiar video game console that always catches my son's eye.

This summer it is the retro Pac Man/Galaga combo machine (which led to a good conversation about the state of video gaming when I was his age - the modern version of having to walk 3 miles in the snow which, by the way I also had to do!). But over the course of a week on Bainbridge we actually took the ferry over a number of times (once to see the King Tut exhibition which is great but incredibly anti-climactic at the end) and we noticed something interesting: no one ever plays the game. To me this was unsurprising, the price per play was $1 - a sum which my son (and I) thought outrageous. Now as an economist and a father, there is never a bad opportunity for some teaching so I asked my son if he though they should price it low enough so that the game was constantly played on each trip (10¢ say) if the goal was to maximize revenue. He said maybe not - good boy, he remembers my lesson of the un-full parking lot! [To wit: if you see a downtown parking lot less than full in the middle of a business day, can you assume the parking lot owner made a pricing mistake? No.]

But certainly they have mucked this one up. $1 is so expensive that it almost never gets played. Compare that to the marginal cost of punters playing it (close to zero) and you understand that the ferry (or the vendor of the machine) have miscalculated the price elasticity badly.

So I have a suggestion: price it as 25¢ and compare profis. I think you'll find you do better.

Monday, July 23, 2012

City and Country GDP: How Does Portland Stack Up?

An interesting little table from the Wall Street Journal lists countries and US metro areas by GDP. Some pretty stunning facts: the NYC metro area's GDP is larger than Mexico's or South Korea's. Chicago has a bigger economy than Sweden!

So how does Portland stack up? Well our economy is bigger than all of Vietnam (and before you dismiss that remember that Vietnam has done pretty well in the last 20 years or so). What struck me is that the Portland metro area economy is bigger then St. Louis, Cleveland, Pittsburgh, Charlotte and Indianapolis (cue the calls for NFL and MLB in Portland).

Catching Up: Oregon Unemployment

Okay, I'm back and ready for action. Time to catch up, starting with the unemployment report. I was off in the mountains last week and was blissfully unaware of the news. But it wasn't that bad, nor was it that great, however. Unemployment rate stuck in the mid 8% range and only 1,700 new jobs added.

Same old story: recovering but at a snail's pace and government job losses creating a huge headwind.

Same old story: recovering but at a snail's pace and government job losses creating a huge headwind.

Tuesday, July 3, 2012

Hiatus

As in: me, on.

I'm taking a little break for the blog for the next few weeks. I may blog on occasion, but not regularly.

I'll try and keep the Twitter feed active with stuff that catches my eye.

I'm taking a little break for the blog for the next few weeks. I may blog on occasion, but not regularly.

I'll try and keep the Twitter feed active with stuff that catches my eye.

Subscribe to:

Posts (Atom)