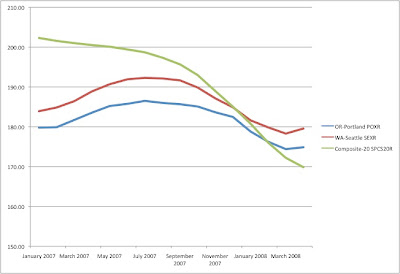

The latest Case-Shiller numbers are out for April 08, I have posted the numbers for Portland, Seattle and the 20 city composite above. The Oregonian is emphasizing the big drop from the year to year number (April 07 was about 184 and April 08 is about 175), but the interesting thing for me is that the seasonal uptick (albeit small) is finally showing up. This is not true of the 20 city composite. Whether this is an anomaly or a signal that the market is not going to crash further is anyone's guess at this point, but I would suspect that ceteris paribus the downturn is bottoming out. However the worsening overall economic conditions might cause this to start its downward march again.

Here is the graph of the numbers themselves.

By the way, the much improved graphics come thanks to my new Mac upon which this blog post was created.

1 comment:

I'm surprised at how well Portland and Seattle are holding up, but -- as always -- I note that the PNW has been behind the rest of the country in this bubble maybe 1 year or so. Perhaps there'll continute to be downward pressure on prices.

Also, while the price indices show the PNW holding up fairly well, I wonder what sales volume has been -- surely much lower on a same-month basis than 1-3 years ago.

I'd also be curious to know price changes in metro vs. outlying areas and 'acreage' properties. Since gas prices have risen dramatically, outlying areas may get hit much harder than inner Portland.

I drove through the massive Villebois development in Wilsonville the other week and it looks pretty depressing. Lots of nice houses for sale with very little activity. The development looks huge but most is unfinished lots. The emptiness alone may deter people from buying the existing houses, no matter how nice they are.

Post a Comment