Friday, November 5, 2010

US Unemployment: Rate Unchanged in October but...

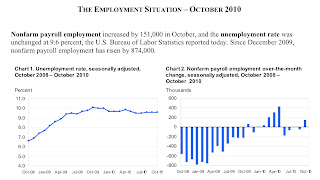

The US economy added a very surprising 151,000 new jobs in October, much higher than most economists expected. The rate was unchanged at 9.6% but this is not surprising. Let's suppose that we can sustain this kind of job growth, many people who have been waiting out the recession will be induced to rejoin the labor force to look for a job. Thus both the supply of jobs and the demand for the jobs increases. So, right now, the number you should focus on is the new jobs number.

In fact, the news in even better when you consider that the government sector shed 8,000 jobs so the private sector job growth was 159,000. This is almost startlingly robust. Still, there are plenty of bad things to point out: the U6 rate which includes underemployed and discouraged workers is still at 17% and the number of long-term unemployed (for a year or more) keeps increasing rapidly.

One interesting question is whether this suddenly makes QE2 unnecessary and dangerous. After all the main argument against QE2 is sparking uncontrolled inflation and the core mechanism of stubborn inflation is wages. But as David Leonhardt points out wages are not keeping pace with productivity gains at the moment, so it is hard to see were inflation is getting traction.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment